The right of first refusal is a powerful tool for real estate investors, allowing them to protect their investments and maximize returns. By understanding the nuances of this legal concept, you can gain an edge over your competition and ensure your rights are protected.

This guide will outline what the right of first refusal entails in real estate transactions, how it works in different scenarios, and how to use it effectively when investing in property. We’ll also look at some potential pitfalls that investors should be aware of before entering into a contract with a right of first refusal clause included.

With this knowledge, you can confidently navigate any deal involving the right of first refusal and ensure that your interests are always sought after.

A right of first refusal (ROFR) is a clause in a real estate contract that gives one party the option to purchase property before it goes up for sale to the general public. This clause is typically included in purchase contracts and can benefit buyers and sellers.

For sellers, a right of first refusal assures them they can get their asking price for the property and time to find another suitable buyer in case the original offer isn’t accepted.

For contingent buyers, a right of first refusal allows them to purchase property before it goes on the market, potentially securing a better deal than if they waited for the property to be listed.

Most realtors would define the right of first refusal as an agreement between the seller and potential buyer, granting the buyer a “right” to purchase the property before any other offer is entertained. This right can be triggered by various factors, including the buyer’s initial offer price and contract terms or the seller’s decision to accept a different offer.

Understanding the right of first refusal regarding real estate transactions is essential because it can help protect your investments and get a good deal. The right of first refusal gives you a chance to buy property before other people have an opportunity, so you may get a better deal than if you waited for it to be listed.

It also lets sellers know that they will get their asking price for the property and gives them time to find another buyer if needed.

When a buyer signs a contract with the right of first refusal included, they essentially agree to purchase the property before any other offers can be accepted. The buyer also agrees to pay a predetermined price if they exercise their first refusal right. The seller, meanwhile, agrees not to accept any other offers until they have heard back from the buyer.

Sometimes, a specific event may trigger the right of first refusal. For instance, if the seller receives another offer higher than the buyer’s initial offer, the buyer may have the option to match or exceed that offer.

In other cases, a predetermined timeline or window of opportunity may trigger the right of first refusal. In this case, the buyer must decide whether they wish to exercise their right of first refusal within a specific time frame.

It is important to note that the right of first refusal does not give eligible buyers preferential treatment over other potential buyers. Furthermore, even if a buyer has the right of first refusal, they must still negotiate a fair price with the seller to secure the deal.

Let’s say you’re a buyer looking to purchase a property. You make an offer of $200,000, and the seller agrees. However, the contract includes a right of first refusal clause, which states that if the seller receives another offer for higher than your initial offer, you have the option to match or exceed that offer within a specific time frame.

The seller receives an offer of $210,000 and allows you to match or exceed that offer. You decide to match the offer, so you submit your own offer of $210,000, and the seller accepts. Because you had the right of first refusal, you could secure the property at a better price than if you had waited for the listing to go public.

Let’s look at another example from a seller’s perspective.

You are a seller looking to sell your property, and you decide to include a right of first refusal clause in the contract. You receive an offer of $200,000 from a potential buyer and allow them the option to match or exceed any higher offers that you receive within a specific time frame.

You receive another offer for $210,000, allowing the initial buyer to match or exceed that offer. The initial buyer decides to match the offer, so you accept their offer of $210,000. Because you included a right of first refusal clause in the contract, you could get your asking price for the property and had time to find another buyer if needed.

Now, let’s look at one more example of a buyer rejecting a right of first refusal.

You are a buyer looking to purchase a property and make an offer of $400,000. The seller agrees, and the contract includes a right of first refusal clause, which states that if the seller receives another offer higher than your initial offer, you have the option to match or exceed that offer within a specific time frame.

The seller receives an offer of $450,000 and allows you to match or exceed that offer. However, you decide not to match the offer because you feel like it is too expensive. Because you rejected the right of first refusal clause, the seller is free to accept a higher offer from another buyer.

In this case, the right of first refusal clause gave you the opportunity to secure the property at a better price, but you decided not to take advantage of it.

As you can see from these examples, the right of first refusal can be beneficial for both buyers and sellers in real estate negotiations. It allows buyers an exclusive window of time during which they are able to get the best deal possible while also giving sellers the opportunity to find a better offer if needed.

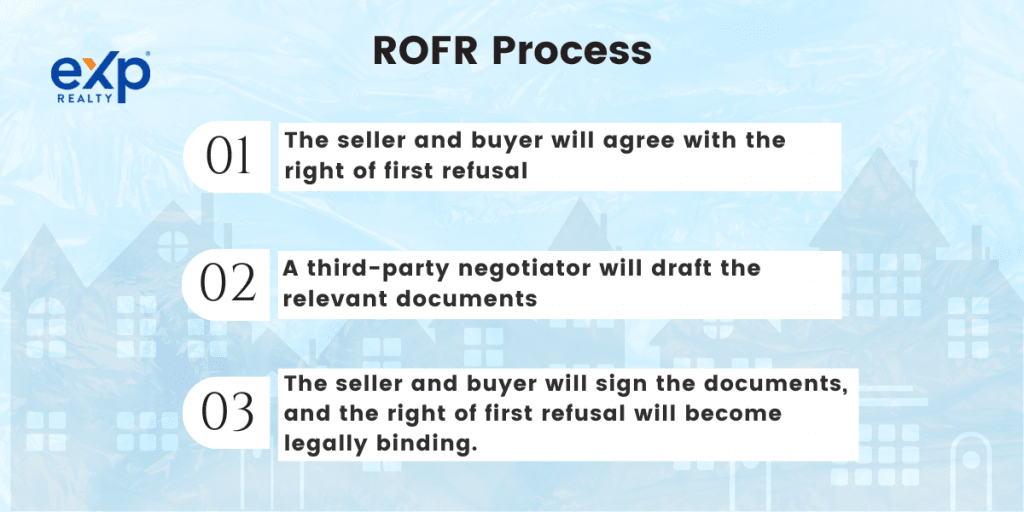

The right of first refusal buying process usually involves three parties: the seller, the buyer, and a third-party negotiator. First, the seller and buyer will agree with the right of first refusal, and then a third-party negotiator will draft the relevant documents. Finally, the seller and buyer will sign the documents, and the right of first refusal will become legally binding.

Once all parties have signed off on the agreement, the buyer needs to keep an eye on any potential offers that may arise during the timeframe specified in the contract. If an offer is made that meets or exceeds the buyer’s initial offer, they must decide within the timeframe specified in the agreement whether to exercise their right of first refusal.

At this point, the buyer may negotiate with the seller to secure a better deal. The seller may also choose to accept the buyer’s initial offer, or they may accept a different one if it is higher than the buyer’s initial offer. In either case, the right of first refusal ensures that the buyer can purchase the property before anyone else.

There are many advantages to having a right of first refusal for both buyers and sellers. Let’s look at some of the most common benefits.

For the buyer, the right of first refusal gives them an advantage over other potential buyers by allowing them to secure the property before it is listed publicly. This means they may be able to purchase the property at a better price than if they had waited for the listing to go public.

In addition, the buyer can negotiate a better price with the seller if they decide to exercise their right of first refusal.

Another advantage of the right of first refusal is that it helps to protect the seller from having to accept a low offer. If another buyer comes in with an offer that exceeds the initial offer, the seller can rest assured that they have a backup option in case the deal falls through.

For the seller, the right of first refusal helps them ensure they get the best deal possible. The seller knows that if a higher offer comes in, they can negotiate with the buyer who initiated the offer. This helps them to avoid any potential bidding wars that could arise if they had listed the property publicly.

In addition, for the seller, the right of first refusal reduces the time they need to spend fielding offers. Rather than spending time sifting through multiple offers and attempting to negotiate with each potential buyer, the seller can let the initial buyer know if any other offers come in that exceed theirs.

While a right of first refusal can benefit both buyers and sellers, it is essential to note that there are a few potential drawbacks.

For the buyer, the most significant disadvantage is that they are not guaranteed to be successful in purchasing the property. They must still negotiate a fair price with the seller to secure the deal, and if a higher offer comes in during the specified period of time, they may be outbid.

In addition, for the buyer, if the seller chooses to accept a higher offer, they may be forced to pay a penalty fee for not exercising their right of first refusal. This could result in them paying more than they would have offered initially.

The seller is disadvantaged if no potential buyers can meet their initial offer. This can lead to the property being stuck in limbo, as the seller will not be able to list it publicly until the right of first refusal expires. This could mean the property is off the market for an extended period of time.

Another drawback for sellers is that they may not be able to get the best price possible for their property. While they are protected from accepting a low offer, if another buyer comes in with an even higher offer, they will not be able to take advantage of it unless the initial buyer agrees to pay more.

Now that you know the basics of a right of first refusal in real estate, here are a few key takeaways to keep in mind:

By understanding the right of first refusal process and its potential benefits, buyers and sellers can make an informed decision about whether or not to include it in their real estate transactions.

Even if you now understand the basics of a right of first refusal, you may still have some questions. Here are some frequently asked questions to help clear up any confusion about ROFRs.

The concept of first refusal in real estate is a great way to protect your investment. This type of agreement allows the owner of a property to refuse any offer made by prospective buyers before they can look at it. This ensures that the seller has the first right of negotiation before they reach out to any potential buyers.

First refusal also gives the seller control over who ultimately purchases the property, allowing them to pick a buyer who best suits their needs and wants. The thought process behind this contractual decision is simple: the seller should have direct authority over who gets their prized asset and knows that no one can swoop in before them and purchase it without consideration.

The doctrine of the right of first refusal is a legal doctrine that states the property owner has the first opportunity to purchase the asset before it is offered up for sale. This gives them the “first right” to buy or negotiate for whatever asset they choose. The doctrine does not offer exclusivity but provides the holder with the first shot at making an offer.

This is commonly used in real estate business transactions and can benefit both future buyers and sellers in any market (including the current market), as it offers the seller peace of mind that their asset will not be sold away from them without consideration. The buyer also benefits from this rights of refusal clause, as they can purchase the property before anyone else gets the chance.

Yes, a right of first refusal is a legally binding business contract between the buyer and seller. It should spell out all the details of the agreement, such as what constitutes an acceptable offer, any fees that need to be paid by either party and when and how each party will receive payment.

This makes it an essential document in any real estate transaction and should be read carefully before all parties sign it.

The main difference between an option and the right of first refusal is that an option gives the holder exclusive rights to purchase a particular property within a predetermined period of time. On the other hand, the right of first refusal only grants the holder the ability to negotiate before any offers from other buyers are accepted.

This means that even if someone else makes an offer on the property, the holder can still make their own offer and potentially outbid them. Therefore, an option allows for a more secure purchase, while the right of first refusal is often seen as an add-on legal clause to protect the seller’s interests.

The right of first refusal can benefit both the buyer and the property owner. For buyers, it allows them to purchase a property before anyone else has the chance. This benefits those who are looking for a great deal on a particular property but don’t want to miss out on purchasing it due to someone else making an offer first.

For the property owner, the right of first refusal gives them peace of mind that their property will not be sold away from them without consideration. In addition, it allows them to negotiate for the best possible deal on the property before any other buyers can make offers.

Finding a real estate agent or real estate attorney who can answer questions about the right of first refusal is not difficult. Most agents are knowledgeable in this area and can provide valuable advice on when and how to use it.

Finding an experienced agent who has worked with actual contracts and real estate transactions is crucial. Additionally, they should be able to explain all real estate terms and conditions of the agreement and answer any questions you may have. Doing some research ahead of time can help you find the right agent for your needs.

Remembering the right of first refusal is an important legal document, so it should be read carefully before signing. However, the right advice and information can be an excellent tool for buyers and sellers alike. Knowing when, why, and how to use it can help both parties achieve their desired outcome in a real estate transaction.

If you have more questions about the right of first refusal in real estate transactions, use https://exprealty.com/agents to search for a local Realtor near you.

If you are looking for homes for sale in gated communities, a great way to keep updated on the latest listings is by signing up for email alerts. Most real estate websites offer this service, and many will even allow you to customize your search parameters so that only relevant properties are sent to you.

For example, you can usually choose the location, property type, contract price range, and other factors to narrow your search. Additionally, some websites may even be able to send you notifications when new listings are available. These alerts can help you stay on top of the latest homes for sale in gated communities near you.

You can also perform a search for what you are looking for and sign up for instant, daily, weekly, or monthly emails at https://exprealty.com/.

The right of first refusal agreement is essential for buyers and sellers in real estate transactions. It allows each party to protect their interests before any offers from other buyers are accepted. Knowing when, why, and how to use it can help ensure that all parties achieve their desired outcome.

Additionally, email alerts can keep buyers informed and up-to-date on new listings in their chosen area. With the correct information, knowledge, and guidance, making a successful real estate transaction can be more manageable.